Can another person pay the tax. Tax officials explained how to pay taxes for other persons

The obligation to pay taxes arises when receiving income in connection with the possession of certain property, etc. The funds must be transferred by a person who receives taxpayer status in accordance with the law. Today, Russians are interested in whether it is possible to pay taxes for another person without violating legal norms.

The essence of the problem

For a long time, individuals transferred money to the budget for their relatives. The person contacted the financial institution, filled out the receipt form and indicated his full name. and taxpayer registration address. Usually 1 person transferred funds for all family members, as citizens consolidate their budgets.

After the appearance of bank cards, citizens began to transfer funds from their accounts. The money was not accepted by the tax authority, which caused arrears. The person became a debtor, and a penalty was charged for the unfulfilled obligation.

The funds were sent to a special account, where they were stored until the actual payer claimed them or asked to be credited to the budget using other details.

After 3 years, the money was automatically written off - the citizen lost the right to get his money back or redirect it towards another obligation.

It was always possible to pay tax for another person on the basis of a power of attorney. A citizen could draw up a document with a notary, which would give a specific individual the right to make payments to the budget for the principal. It is impossible to check the presence or absence of a document when conducting transactions through special applications or terminals using bank cards.

When paying taxes for another person, a power of attorney is required.

The Federal Tax Service could not determine whether it was possible to pay tax for another person in each case. Therefore, representatives of the government body have repeatedly notified interested parties through official publications that all money received from third parties without submitting a power of attorney remains unaccounted for. This position is set out in the department’s letter No. 3N-4-1/21494 dated December 8, 2015.

In 2004, the Constitutional Court of the Russian Federation decided that it was inadmissible to offset funds received from third parties against the fulfillment of tax obligations. Several reasons have been given:

- complexity of tax control;

- creating conditions for concealing income;

- impossibility of personifying incoming funds.

Since November 2016, new rules for transferring funds to the budget have been in effect. Amendments were made to Article 45 of the Tax Code of the Russian Federation by Law No. 401-FZ of November 30, 2016. The document was supplemented with a rule according to which any person can transfer money for a taxpayer without any restrictions.

What is it for

The change in legislation is aimed at simplifying settlements with government agencies. Now any person has the right to pay tax for another citizen if he does not have sufficient funds at the moment or is physically unable to do so. No special documents are required for this.

Also, the owner of an organization can pay tax for a legal entity if there are insufficient funds in the current account. There is no point in transferring money to the company first and waiting for it to be credited in order to make the payment to the budget.

In some cases, tax must be paid for the counterparty company if the business partner is experiencing significant difficulties in paying off receivables. Tax arrears are fraught with the seizure of accounts and a complete stop in the organization’s activities.

Changes to the Tax Code of the Russian Federation were made to improve budget capacity. The more ways interested parties have to fulfill tax obligations, the lower the likelihood that a conscientious payer will make late payments.

In special cases, it is allowed for a counterparty to pay taxes for a legal entity

Payment Features

After transferring funds, the actual payer completely loses rights in relation to this property. The payment is accounted for by the taxpayer. If, for example, an amount was transferred that exceeds the amount of obligations to the state, then only the taxpayer can claim the excess.

Some citizens are interested in whether it is possible to pay tax for another person and then return the money.

Paragraph 1 of Article 45 of the Tax Code of the Russian Federation states that an organization or citizen who has fulfilled a tax obligation for another person does not have the right to demand the transfer of this amount back.

The restriction is set to combat fraudulent activities. For example, a citizen is on the list of debtors to the state, another person transfers money to the budget. After fulfilling the obligation, all restrictions on the disposal of property are removed from the taxpayer.

When filling out the column, the payer indicates his full name. citizen or name of the organization that transfers the money. The taxpayer's information is entered in the "Purpose of payment" field.

You can make a payment:

- in person at the bank;

- via terminal;

- using the bank's mobile application;

- using an electronic wallet.

The actual payer may make a mistake and transfer money to pay tax for a person whose obligations to the state he did not intend to pay off. In this situation, the interested person should contact the bank. Only the taxpayer can clarify the purpose of the payment in the described case.

If the money was actually transferred, then a judicial defense remains. A citizen has the right to file a lawsuit to recover money from a third party whose tax obligation was erroneously fulfilled due to unjust enrichment.

Money transferred by mistake to pay taxes for another person is not refundable.

How are funds accounted for from a legal point of view?

The Federal Tax Service does not consider a payment received from a third party as a citizen’s income. A person is not obliged to report to the department about the fact that a third party has transferred the amount of tax for him.

Organizations may reflect the payment of tax liabilities for third parties in the category of expenses when calculating income taxes. To do this, it is necessary to document the fact of payment and justify it. If a company transfers funds to the budget for a third party for charitable reasons, then such expenses will be compensated from profits.

The Tax Service may initiate an audit against commercial companies that make payments to the budget for other organizations or individuals. Company funds must be spent in accordance with statutory activities, and expenses must be documented in accordance with accounting rules.

Organizations have the right to enter into a loan agreement, under which the actual payer provides a commercial loan to a third party, transferring money to the budget. The tax may be transferred as part of the fulfillment of another obligation, for example, in payment for products under a supply agreement or services under a corresponding contract.

Citizens and organizations have the right to pay taxes for third parties without issuing a power of attorney or other documents. You should carefully indicate the taxpayer’s information, since if the Federal Tax Service accepts the payment, the money cannot be returned.

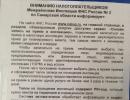

It is clarified that in order to pay tax for a taxpayer, his representative must have a power of attorney (letter of the Federal Tax Service of Russia dated December 8, 2015 No. ZN-4-1/21494@ " ").

Let us remind you that the taxpayer is obliged to independently fulfill his obligation to pay tax (). But at the same time, the interests of the payer can be represented by his authorized representative (). Then this fact must be indicated in the payment slip for the transfer of tax amounts to the budget, the tax service emphasizes. Specialists from the Federal Tax Service of Russia add that the tax authorities do not have the right to request documents confirming the ownership of the money from which taxes were paid.

Tax officials also note that the authority of the representative must be documented (). Such confirmation for a representative individual is a notarized power of attorney (). But not only - there are powers of attorney that are equivalent to notarial ones (). This is, for example, a power of attorney from a prisoner, certified by the head of the prison, or a power of attorney from a military serviceman, which the commander of a unit (formation, institution, institution) has the right to certify if there are no notarial bodies at the point of deployment.

You can also present a copy of the power of attorney. However, a regular copy of the document, according to the tax authorities, will not work. It must be certified by a notary with his signature and seal.

However, the bank does not check the documents of individuals when submitting payment slips, and it is also impossible to check the authority of the representative when paying taxes online. At what stage of payment or tax control the representative must present a power of attorney - the Federal Tax Service of Russia does not specify.

The conveniences and advantages of remote servicing through the Sberbank Online system are undeniable. After all, without the participation of an operator or without using an ATM, you can independently, from your home computer or from a mobile application, perform various banking operations. But if everything is quite simple with writing off utility bills, paying for goods and services, and money transfers, then paying taxes correctly can sometimes be problematic. After all, if there is inaccuracy, it will be unclear who exactly pays what kind of tax.

Making an online tax payment requires care

Among the information specified in the payment document for the payment of tax there are the main parameters by which it is identified:

- ID (document index) - if payment is made according to a receipt issued by the Federal Tax Service, received through the MFC or State Services.

- TIN (individual taxpayer number) and KBK (budget classification code) - when the taxpayer fills out a payment document independently (for example, based on a notification).

If even the slightest inaccuracy is made when specifying these details, the payment is regarded by the tax authorities as unclear. The money was received into the budget, but it was not debited from those who paid. And a situation may well arise when a taxpayer who made a mistake receives a demand for payment of the same amount, while he believes that he has fully settled with the state.

Who, for whom and what tax can pay

The Tax Code of the Russian Federation does not contain any restrictions regarding the definition of the circle of persons who have the right to pay taxes, fees and contributions for taxpayers. As well as for those whose duties to contribute money to the budget are fulfilled, there are no restrictions. That is, both third parties (those who do not pay for themselves) and taxpayers (those for whom payments are made to the state) can be individuals, individual entrepreneurs, as well as enterprises, organizations and other legal entities, as they say, "in any combination." At the same time, you can entrust another person to make a payment through Sberbank Online, even if the taxpayer has a different region of registration. The most common situations are paying property taxes for relatives or making current payments for your company when there is not enough money in the account.

Any taxes and fees (including state duties), as well as penalties and fines for them, are accepted for payment. Insurance contributions for compulsory pension and health insurance, in case of temporary disability and in connection with maternity are also allowed to be made by third parties. An exception is made for contributions from industrial accidents and occupational diseases (abbreviated as “for injuries”), since the tax authority is not the recipient of these amounts (they are administered by the extra-budgetary social insurance fund). You can deposit funds both in terms of current tax obligations and in the account of repayment of debt from previous periods.

You can pay “not your own” tax, just be careful

The procedure for working in Sberbank Online when paying tax for another person is practically no different from that used when making your own payment. Login to the system using your username and password. Next, go to the “Payments and Transfers” menu, subcategory “Staff Police, Taxes, Duties, Budget Payments.”

If you have a receipt, then you need to click “Search and pay taxes to the Federal Tax Service” and in the form that opens, select payment of taxes according to the index of the payment document. When you enter the index (indicated at the top of the receipt), the system will automatically find and identify the payment. You just need to make sure that the amount paid is for the person whose receipt it corresponds to.

In cases where it is not necessary to make a current payment, but to pay off a debt, there is no payment document on hand. Therefore, you need to select the “Search for overdue taxes by TIN” service. By entering the taxpayer identification number for whom you want to pay off debts in the field, you can see all the amounts due. Having selected the one that is subject to payment, you should begin to generate a payment document online, sequentially entering all the necessary data (TIN, full name, registration address, etc.)

Confirmation of payment in both cases will occur as usual - after entering the special code received in the SMS message and the blue “Completed” stamp appears on the payment document.

When paying taxes to third parties, the following must be taken into account:

- No tax payments can be made from a credit card - the transaction is only possible from a debit card.

- You can clarify any payments, with one exception. It will not be possible to make an adjustment to the paid insurance premiums for compulsory pension insurance if the Pension Fund of Russia division manages to take into account the received amounts in the personal accounts of the insured persons.

- Having sent money “for that guy,” the owner of the card from which it was debited completely loses the right to demand a refund to his card. In case of overpayment or incorrect payment, they will be returned only to the person for whom the tax was paid.

The rules that taxes, fees and contributions can be paid for the taxpayer by third parties were introduced by Federal Law No. 401-FZ of November 30, 2016. By introducing amendments to Article 45 of the Tax Code of the Russian Federation, the legislator significantly simplified the procedure for making payments to the budget.

Many of us have tried to pay at least once. tax for another person. These could be parents, children or spouses. You sent money from your account, it was written off, but your loved one's tax debt remained unchanged. For a long time, citizens were obliged to pay their taxes only for themselves and only from their own account.

We'll tell you whether it's possible to pay someone else's tax in 2018

On November 30, 2016, the legal tax procedure changed in favor of taxpayers. From this date, amendments to the Federal Law on the right to pay taxes by so-called third parties came into force. This means that a spouse can pay his "other half's" tax, a daughter can pay the tax of her elderly parents, a father can transfer money for his son's tax, etc.

Are we talking only about individuals?

No, not only. You can pay tax for both an organization and an individual entrepreneur.

Are there any restrictions for persons who intend to pay the tax not for themselves?

Restrictions from the tax code No, therefore, different options for paying taxes and other fees are possible:

- any individual has the right to pay taxes of another individual, organization or individual entrepreneur;

- each individual entrepreneur can pay tax for another individual entrepreneur, organization or individual;

- any organization is allowed to pay tax for another organization, individual entrepreneur and individual.

What taxes and duties can be paid to third parties?

- Value added tax (VAT);

- Excise taxes;

- Personal income tax (NDFL);

- Income tax;

- Mineral extraction tax;

- Water tax;

- State duty;

- Unified Agricultural Tax (USAT);

- Single tax under the “simplified system” (STS);

- “Patent” tax (PSN);

- Unified tax on imputed tax (UTII);

- Organizational property tax;

- Gambling tax;

- Transport tax;

- Land tax;

- Property tax for individuals;

- Trade fee.

There was an overpayment, can I get my money back?

If you paid someone else's tax and an overpayment occurred, you will not be able to return the money without the participation of the taxpayer himself. That is, it is possible to return the excess amount only to the account of the person or organization for whom you paid the tax.

Today, paying various payments and utilities via the Internet is very popular. Thanks to the Internet, all operations can be performed without leaving home. Fast payment of taxes through the online service is the most convenient function provided by Sberbank. After all, many people put off paying taxes until the very last moment. The reason for this is the huge queues. The very thought that you will have to stand in line for hours, and this procedure will take a lot of time, makes you delay paying until the very end. As a result of this, many people have debts to the country, which results in a lot of problems. Many Sberbank clients have a question about whether it is possible to pay tax through Sberbank Online for another person. Today, every citizen has an excellent opportunity to pay tax contributions online. Thanks to this, all payments will always be made on time, and you will only have to spend a few minutes. This method allows you to avoid penalties and problems with the service. What is needed to carry out such a procedure?

Making a payment

In order to pay taxes through Sberbank Online, you must follow the instructions:

- Log in to the system, and you will be taken to your personal account;

- prepare a receipt provided by the service or saved from your personal account on the Federal Tax Service website;

- in the menu, click on the “Payments and transfers” section;

- indicate the subcategory “Staff Police, taxes, duties, budget payments”;

- from the entire list, click on “Federal Tax Service”;

- click on “Search and pay taxes to the Federal Tax Service”;

- a window with a tax payment form opens in front of the client;

- select “Payment of taxes by document index”;

- indicate the card or account from which funds will be debited.

- In the document index field, you must enter the number that is indicated on the received receipt. It will indicate that the payment is made specifically for the person who owns the received paper. If you couldn’t find it, you can click on “How to fill out this field?” and an example of a receipt will open in front of the client.

- Next, you should continue filling out all fields;

- enter the index number;

- click on the “Continue” button;

- If the system finds this document, then the already completed payment form will open in front of the client.

The form will contain details that may not match those indicated on the receipt. You shouldn’t be scared, because after moving to the next page they will definitely come together.

If the amounts in the receipt and the form match, you can click on the “Continue” button.

When paying for taxes using the document index, no commission is charged to the client. Next, you must confirm the procedure with a code that will come in an SMS. If everything went well, a blue “Completed” stamp will appear. If necessary, you can print a receipt that will confirm the payment.

Payment via terminal

If you don’t have the Internet at hand, you still don’t need to waste your time at the bank, since you can make payments through the Sberbank terminal. Before paying, you need to decide how the payment will be made - cash or card. If you pay in cash, you need to follow the instructions:

- touch the terminal screen and select “Payments in our region”;

- click on “Search for payee”;

- the most optimal method is to search by barcode, but this is not available on all papers;

- If you search by name, the client will be given a huge selection of names and this is not entirely convenient;

- It’s best to make money using “Search by TIN”;

- in the field you must enter the TIN, which is indicated on the received receipt;

- if the client entered the TIN correctly, the desired recipient will be displayed on the screen;

- You need to select the option “by receipt from the Federal Tax Service website”;

- Having selected this item, you need to bring the barcode of the receipt to a special scanner;

- After the scanner has read the barcode, all the details will be displayed on the screen. They must be checked for correctness and click “Continue”.

- If the chosen method is cash, then you need to insert the bills into a special compartment. You need to pay as much as indicated on the receipt. If there is no calculation, the terminal will display the message “The maximum amount has been exceeded.” The balance can be sent to your mobile or home phone account. To do this, click on “Make change”.

If you pay with a bank card, the funds will be debited instantly. After the operation, you must receive a receipt that will certify the payment. If a check is lost, it can be reprinted through Sberbank Online, since all payments are saved in history.